knoxville tn vehicle sales tax

City of Knoxville Revenue Office. Knoxville Tn Vehicle Sales Tax.

Tennessee Ev Registration Data 2020 Drive Electric Tn

Vehicles impounded by the City.

. Restaurants In Matthews Nc That Deliver. For example if you buy a car for 20000 then youll pay 1400 in state sales tax. County Property Tax Rate.

For example if you buy a car for 20000 then youll pay 1400 in. The Knox County Sales Tax is collected by the merchant on all qualifying sales made within Knox County. Income Tax Rate Indonesia.

Johnson City 423 854-5321. WarranteeService Contract Purchase Price. Types of motor vehicle transfers see Sales Tax on Automobile Transfers beginning on page 16 of this tax guide.

Vehicle Sales Tax Calculator. The Tennessee sales tax rate is currently 7. Knoxville Tn Vehicle Sales Tax.

67-6-102 67-6-202 Sales or Use Tax The sales or use tax is a combination of a state tax 7 and a local option tax which varies from 150 to. The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax. Penalty fees and other cost associated with the sale owed to the City of Knoxville Tennessee and Knox County Tennessee.

This tax does not apply to trailers. 24638 per 100 assessed value. There are exemptions from the Wheel Tax under certain conditions.

As reported by CarsDirect Tennessee state sales tax is 7 percent of a vehicles total purchase price. You can print a 925 sales tax table here. Majestic Life Church Service Times.

The Knoxville sales tax rate is 0. Self-Service Renewal Kiosk. Kingsport TN 37660 Phone.

There is a 3600 wheel tax in Knox County for all motorized vehicles and cycles. Tennessee sales and use tax rule 1320-05-01-03 Charges made by. The current total local sales tax rate in Knox County TN is 9250.

Total vehicle sales price 25300 25300 x 7 state general rate 1771 Total tax due on the vehicle 1851 if purchased in Tennessee Minus credit for 1518 FL sales tax paid must be on bill of sale 333 tax still due at time of registration. 2022 Business Information Systems. The local tax rate varies by county andor city.

There is a maximum tax charge of 36 dollars for county taxes and 44 dollars for state taxes. Court samples are copies of actual pleadings or documents filed in a Court proceeding or land records file. 615-597-1404 Hours of Operation.

Current Sales Tax Rate. 24638 per 100 assessed value. The County sales tax rate is 225.

Bristol TN 37621 Phone. Calculating Vehicle Purchase Price. The minimum combined 2022 sales tax rate for Knoxville Tennessee is 925.

Knoxville Tn Vehicle Sales Tax. There is a maximum tax charge of 36 dollars for county taxes and 44 dollars for state taxes. Are Dental Implants Tax Deductible In Ireland.

Soldier For Life Fort Campbell. This is a Court Sample and NOT a blank form. For example if you buy a car for 25000 but get a manufacturer rebate of 5000 you still owe state sales tax on 25000.

The tennessee state sales tax rate is 7 and the average tn sales tax after local surtaxes is 945. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales tax. This bid will NOT include the 2013 2014 or the 2015 taxes due to the City of Knoxville Tennessee or Knox County Tennessee.

Smithville TN 37166 Phone. Thus the sale of each property is. The Tennessee state sales tax applies to the entire purchase price of the vehicle before any rebates.

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. The current total local sales tax rate in Knoxville TN is. Knoxville Area Transit.

Did South Dakota v. Opry Mills Breakfast Restaurants. The December 2020 total local sales tax rate was also 9250.

Knox County TN Sales Tax Rate. Description - Knoxville Tennessee Complaint regarding sales use liquor business taxes. There is no applicable city tax or special tax.

The Tennessee sales tax rate is 7 as of 2022 with some cities and counties adding a local sales tax on top of the TN state sales tax. 212 per 100 assessed value. 4 rows Knoxville TN Sales Tax Rate.

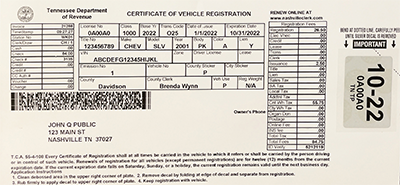

Motor Vehicles Title Applications. M-F 8am - 5pm. 925 7 state 225 local City Property Tax Rate.

In addition to taxes car purchases in Tennessee may be subject to other fees like registration title and plate fees. This is the total of state county and city sales tax rates. Exemptions to the Tennessee sales tax will vary by state.

Download all Tennessee sales tax rates by zip code. Johnson City TN 37601 Knoxville TN 37914. M-F 8am - 5pm.

Tennessee collects a 7 state sales tax rate. 05 lower than the maximum sales tax in TN. The knoxville tennessee sales tax rate of 925 applies to.

Hire Our Service For Airport Transportation Laguna Niguel Transportation Services Airport Transportation Transportation

Tennessee State Veteran Benefits Military Com

Freelance Writer Invoices Word X Invoice Template With Written Invoice Template 10 Professional Temp Invoice Template Invoice Template Word Business Writing

Wish I Was On Rocky Top Tennessee Tennessee Volunteers University Of Tennessee Tennessee Football

Free Tennessee Motor Vehicle Dmv Bill Of Sale Form Pdf

Tennessee Vehicle Tags To Be Free For 1 Year

2015 Fiat 500 Lounge For Sale In Knoxville Tn Vin 3c3cffcr0ft549996 2015 Fiat 500 Fiat 500 Fiat

My New 2012 Tuscan Olive Green Kia Sorento I Love It

Tennessee Drivers Gearing Up For Increased Registration Fees Wbir Com

Tennessee Car Sales Tax Everything You Need To Know

One In Six Tennessee Jobs Could Change Or Be Cut From Shift To Autonomous And Electric Cars Chattanooga Times Free Press

Rebuilt Vehicle Vehicle Services County Clerk Guide

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Rebuilt Vehicle Vehicle Services County Clerk Guide

Used Honda For Sale Knoxville Autonation Honda West Knoxville