how much is inheritance tax in georgia

1-800-959-1247 email protected 100 Fisher Ave. Any deaths after July 1 2014 fall under these rules.

Effective Rates Inheritance Tax In Usa 1995 Download Table

Any deaths after July 1 2014 fall under these rules.

. How Much do States Charge in Inheritance Tax. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels. Americas 1 tax preparation provider.

Even with this welcome benefit there are some returns that must be filed on behalf of the decedent and their estate such as. Your average tax rate is 1198 and your marginal tax rate is 22. How Much is Inheritance Tax.

If you make 70000 a year living in the region of Colorado USA you will be taxed 11001. What restrictions there are and whether making a will is advisable. Now the bigger question is how much will you pay if you pay inheritance taxes.

1 online tax filing solution for self-employed. If you earn less than 25000 in Iowa youre exempt from taxes. For instance in Pennsylvania the inheritance tax applies to heirs who live out of state if the decedent lives in the Keystone State.

When someone dies their estate goes through a legal process known as probate. If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498. How Much Does an Executor Get Paid in Georgia.

If no amount was included in the will it would be 2-12 percent on all money received into the estate and 2-12 percent for amounts paid out of the estate. Check local laws to see if this might apply to you. The Tax Foundation is the nations leading independent tax policy nonprofit.

29 cents per gallon. The IRS offers an estate tax exemption. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022.

Headline gift tax rate Donation of property is taxed under the stamp tax at 08. If you earn over 25000 youll pay between 0 15 in inheritance tax but there are some. There is no inheritance tax in Georgia.

Each state differs in its tax rate and exemptions. Inheritance tax is different. This marginal tax rate means that.

Theres good news though. The Global Property Guide looks at inheritance from two angles. This marginal tax rate means.

Learn more about Probate Laws in your state. Average state and local sales tax. Because the state is free of inheritance tax heirs to an inheritance wont be taxed on it.

The Senior School Tax Exemption L5A provides a 100 exemption from taxes levied by the Gwinnett County Board of Education on your home and up to one acre of property. Any estate thats worth less than 117 million does not owe estate tax. 952 White Plains NY 10606.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Free acquisition of goods by individuals inheritance and gifts is taxed under the stamp tax at 10. Any amount over the 117 million however is taxable.

Georgia Code 53-6-60 says that executors may be paid as stated in the will. Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015.

Georgia has no estate tax and no inheritance tax. You must be 65 years old as of January 1 of the application year or 100 totally and permanently disabled and must occupy your residence within the Gwinnett County School District. Another states inheritance tax could still apply to Georgia residents though.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Overall Rating for Taxes on Retirees. Puerto Rico levies estate and gift taxes on the net taxable value.

State income taxes are low ranging from 1 percent to 6 percent and the average state and local sales tax rate is 701 percent. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. Your average tax rate is 1198 and your marginal tax rate is 22.

How much federal tax the estate owes depends on the balance. How Long Does It Take to Get an Inheritance. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes.

INHERITANCE TAX How high is income tax on residents in Puerto Rico. In addition to the federal estate tax of 40 percent some states levy an additional estate or inheritance tax. No Georgia does not have an estate tax or an inheritance tax on its inheritance laws.

We are open 24 hours a day 7 days a week. Headline inheritance tax rate Free acquisition of goods by individuals inheritance and gifts is taxed under the stamp tax at 10. Georgia also has no gift tax.

Taxation and what inheritance laws apply to foreigners leaving property in Puerto Rico. Localities can add as much as 56 to that but the average combined levy is 84 according to the Tax Foundation. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

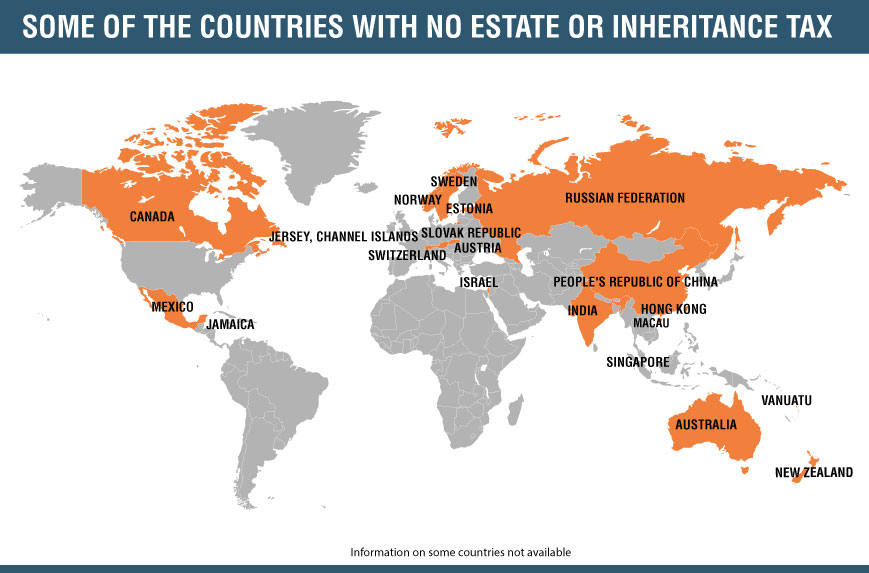

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Inheritance Data On Twitter Inheritance Tax Inheritance Facts

Property Investment Financial Planning Inheritance Tax Ltd Company Versus Private Personal Ownership Anyone Inheritance Tax Investment Property Inheritance

Effective Rates Inheritance Tax In Usa 1995 Download Table

Inheritance Tax Here S Who Pays And In Which States Bankrate

Sell Inherited Home Fast For Cash Distressed Property Selling Your House We Buy Houses

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State By State Guide To Taxes On Retirees Inheritance Tax Estate Tax Purple States

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

What Is Inheritance Tax Probate Advance

Georgia Estate Tax Everything You Need To Know Smartasset

Is Your Inheritance Considered Taxable Income H R Block

Inheritance Taxation In Oecd Countries En Oecd

In Addition To The Federal Estate Tax With A Top Rate Of 40 Percent Some States Levy An Additional Estate Or Inheritan In 2022 Inheritance Tax Estate Tax Inheritance

Swiss To Vote On Federal Inheritance Tax Wsj

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Inheritance Tax Here S Who Pays And In Which States Bankrate